A startup’s origin story is crucial. It includes the issues they address, the recommendations made, the victories achieved, the objectives they have for the future, and the plans they have to achieve those objectives.

It’s the real reason we say that stories are significant.

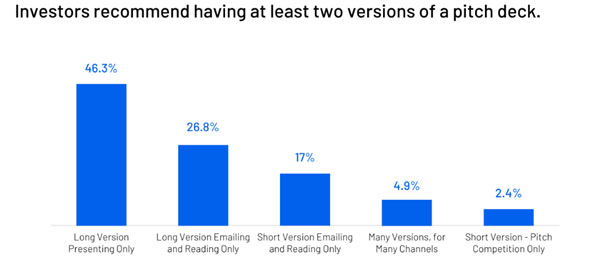

However, there are countless ways to convey the story of a startup. Founders are urged to have several iterations of their pitch deck, in particular.

But the majority of entrepreneurs find themselves asking two queries:

- How many revisions are necessary?

- How do these variations appear?

A quick Google search will turn up a variety of investors’, consultants’, and business people’s perspectives. However, these viewpoints frequently conflict with one another, making it challenging for the typical founder to obtain specific and reliable responses to crucial questions.

We set out on a quest for more clarity in our effort to assist founders in building pitch decks that secure funding. We gathered investor opinions and quantitatively analyzed them in search of trustworthy solutions.

Online, there are 21 investor opinions on the need for different pitch decks.

Discussing methodology; we started by searching the internet for articles about different pitch decks. We checked the credentials of the authors of the sources we discovered, eliminated consulting firm opinions, and only kept investor opinions.

We gathered a total of 21 resources from venture capitalists and investment companies. Posts on blogs, articles, and books were used as resources.

We discovered during our research that the majority of investors referred to different pitch deck versions by different names.

We standardized their viewpoints based on mutual function and common language to prevent misunderstanding.

Let’s get to the data.

Investors recommended a total of five different iterations, but only two or three were crucial.

Investors suggested the following five categories for pitch decks:

- The version in Length: Presenting Only

- Emailing and Reading Only, Long Version

- Only Emailing and Reading, in Brief

- Summary: Pitch Competition Only

- Multiple Versions, Multiple Channels

According to our quick research, all of the investors and investment firms concur that founders should have two different pitch decks: a “long version” and a “short version.”

So, how many versions of a pitch deck do investors recommend?

At least two, but the three most popular advices were as follows:

- Long Version for Presenting Only

- An extended version for reading and emailing only

- A condensed version for reading and emailing only

But how do they appear? Let’s examine our findings in more detail to learn the true sentiment of investors.

(46%) Long Version for Presenting Only

A lengthy version of the pitch deck that is only for presentations is advised by nearly half (46%) of investors.

Investors claim that this Long Version for Presenting Only contains 10 to 15 slides and is designed to be delivered in no more than 60 minutes.

This version is known as a “presentation backdrop” by most investors. They advise that this version contain crucial information like data, charts, and product demos and be more visually appealing and less text-heavy because it serves as a visual aid for investors. Investors advise replacing text-heavy slides with high-level speaking points.

Investors are of the opinion that an audience may become distracted by excessive text if a speaker is present.

A well-known investor and consultant for us says:

You should have two copies of the pitch deck: one to use when delivering the pitch in person and another with more information to send to people who will read it independently. When giving a presentation in person, you only want to cover the most important points because you want the audience to be paying attention to you and not straining to read the minute details on your slides.

Long Version for Reading and Emailing Only (27%)

What many investors referred to as the “standalone version,” or what we’re calling the Long Version for Emailing and Reading Only, is secondary to the Long Version for Presenting Only.

With 26.83% of investors recommending it, this pitch deck version is the second most frequently suggested by investors.

Individual investors are intended to receive and read standalone decks via email. Stakeholders or investors will also distribute it internally for further review. As a result, this version is lengthier and a little more verbose (while still having excellent design, of course).

The appendix and expanded text on each slide contain the majority of the extra information.

Given how many decks are sent to investors each day, this also serves as a way to address any questions that might come up.

They prefer to compile all the necessary information at once so they can swiftly reject opportunities that don’t align with their goals.

(17%) Abbreviated Version for Reading and Emailing

Investors frequently refer to a different, relatively shorter version of a standalone deck as the “teaser deck.”

The “short version” is what we refer to it as when emailing and only reading.

This version serves as a briefing document to inform investors of what to expect during the pitch, just as its name implies.

Typically, teaser pitch decks are a succinct business overview that includes the following:

- Your identity

- Your actions

- What makes you special

- What makes the market opportunity so large?

One venture capitalist from US recommends that teaser pitch decks should be around 8-12 slides.

According to them:

Regardless of whether you are fund-raising or not, you should always have a “teaser deck” ready to send. The reader should be able to scan your materials quickly and visually and gain an understanding of who you are, what you do, why you’re truly unique, and why the market opportunity is enormous.

(5%) Many Versions, for Many Channels

After discussing the top three most used variations, let’s examine the remaining ones.

Only two of the investors in our study agreed that a founder can never have too many iterations of the pitch deck. 5% of investors, according to our quick research, advise having virtually unlimited versions, and for good reasons as well.

This suggests that there are different pitch deck versions depending on the audience and the intended method of consumption. While some pitch decks are designed to be independently studied by investors, others are used as a “backdrop” during presentations.

However, investors also advise developing pitch decks that are specifically targeted at investors.

(2%) Pitch Competition Only, Short Version

The pitch competition deck is an additional version that might be useful.

Only 2% of investors (one out of 21) in our study recommended using this pitch deck, making it the least popular. That does not, however, imply that it is not required.

During pitch competitions, competition pitch decks—which typically have 8–10 slides—are presented live on stage. Companies typically have five minutes to publicly present in front of dozens of other startups.

The fundamentals should be covered in both teaser decks and pitch competition decks, including:

- Your identity

- Your actions

- Why are you special

- What makes the market opportunity so large?

However, pitch competition decks frequently have less text and more visuals because they are meant to be presented onstage or in a showy manner. Contrarily, teaser decks are intended to be read by investors, necessitating more copy and occasionally more slides.

Conclusion: Founders most likely won't be able to get by with just one pitch deck.

To address one of the most pressing queries founders have: How many pitch deck versions do I need to make? we gathered and analyzed investor opinion.

Here is a summary of what we learned:

- Investors think founders should have two different versions of their pitch decks.

- Most frequently suggested: According to our study’s investors, 46.34%, a complete presentation deck should be used as a visual aid during pitches.

- Second most popular: 26.83% of investors think that when seeking funding, a full pitch deck should be sent via email.

- A Short Version for Reading and Emailing Only came in third place, with 17% of investors recommending it.

Startup stories can and should be told in a variety of ways, with varying degrees of detail, and through a variety of media.

The good news is that you don’t have to go crazy making endless variations. Probably only two are necessary for startups. Maximally three.